Surplus and Survival: Oil and Gas Today (ADIPEC 2015)

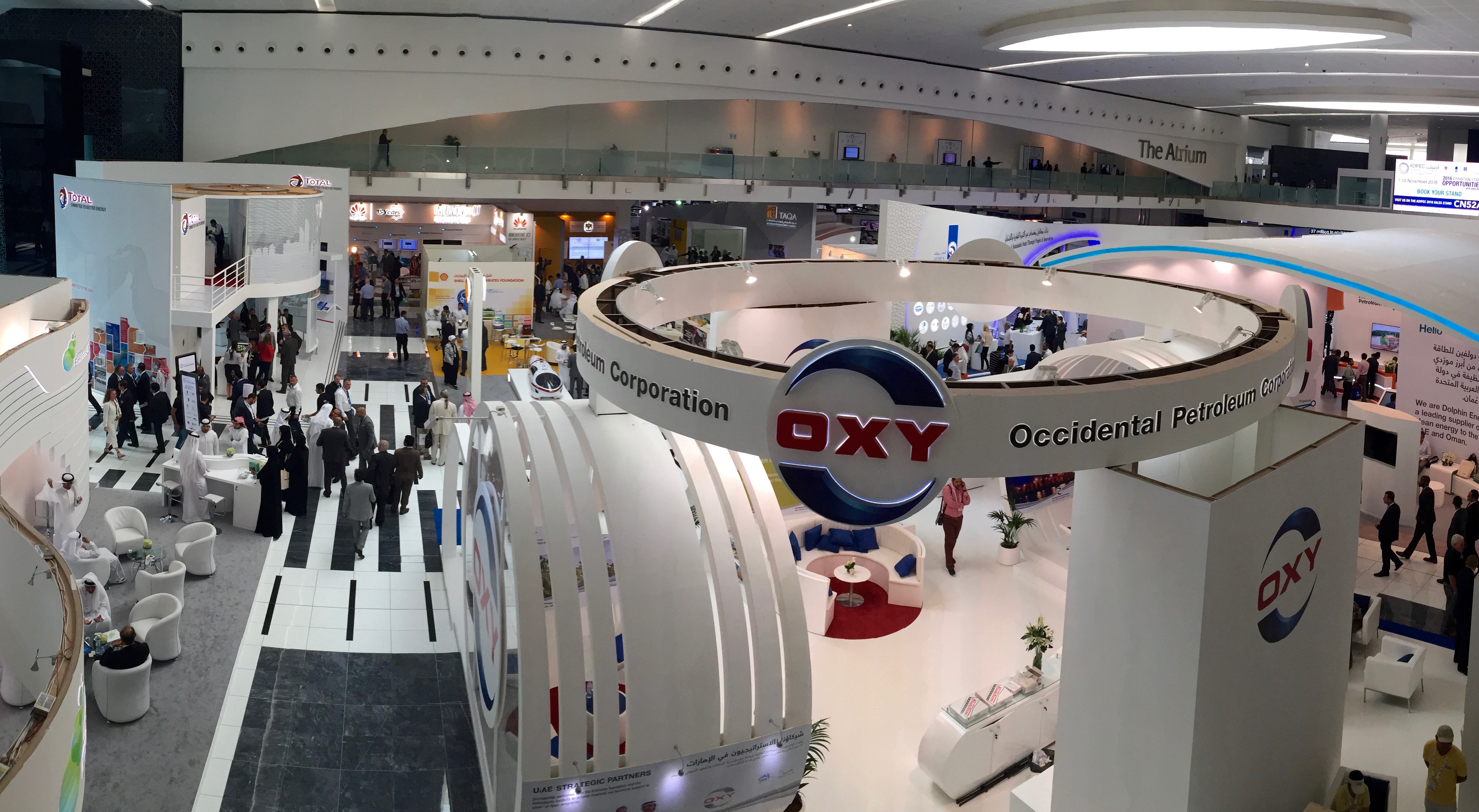

Global economic uncertainty, maverick competition, and wild price swings over the last two years have put energy companies on notice to transform their businesses. ADIPEC 2015 in Abu Dhabi brought together 540 organizations from 65 countries over three days to discuss innovative solutions.

ADIPEC is the largest such affair in Asia. And yet, despite the collective navel-gazing on an unprecedented scale, several nagging questions remain. How can major exporters survive a market with lower energy demands? How can profits be maintained without substantial cuts in investment, manpower and construction? How will innovation, especially the need for sustainable energy, change the present state of the oil and gas industry?

It will yet take some time to answer them. One thing seems clear the industry cannot afford to drastically downsize its workforce with 30% growth expected in the next 25 years.

Innovation Forges Ahead

The answer to survival lies in focused innovation according to UAE minister of Energy Suhail Al Mazrouei. That means using technology to extract as much oil as possible from existing wells and as the same time developing sustainable forms of energy. Even with oil down 50% in price the UAE will continue to invest and won’t be cancelling projects.

He further states that innovation is now widely recognized as the main driver of industrial growth. It can be a primary source of sustained competitive advantage. The power of innovation encourages all sectors in the UAE including oil and gas to reduce costs, improve management and develop thriftier extraction methods.

Global oil prices have fallen sharply since 2014, costing many energy exporting nations the substantial profits to which they had grown accustomed. At the same time consumers and industry in many importing countries are paying less for energy. The reasons are weak demand owing to minimal economic growth combined with quickly rising US production.

Daniel Yergin, the Pulitzer-Prize winning author and keynote speaker at ADIPEC said: “The biggest factors affecting oil prices are the astonishing growth of US shale oil, the tepidness of global demand, the battle for market share, the uncertainties surrounding geopolitics and the re-entry of additional production from Iran.”

Prices Headed North?

Total CEO, Patrick Pouyanne says, “I don’t see oil prices recovering substantially over 2016. This is a commodity business after all, it is made of cycles, and volatility is part of the game.”

Additionally, the oil cartel OPEC is determined not to cut production as a way to increase demand and prop up prices whilst curtailing production and investment in high-cost countries. Their primary focus now is on driving capital and operating efficiency to preserve their margins and maintain the reinvestment rates necessary to grow production.

As the ground shifted dramatically, the outlook for the oil industry is quite different today compared to how it looked just a couple of years ago, when the oil industry was effectively controlled by national cartels. That traditional structural discipline has been replaced by a systemic imbalance of greatly increased supply and receding demand.

Global economic weakness in Europe and then China has been accompanied by tougher fuel economy regulations, more viable forms of alternative energy and the development of more efficient equipment as motor cars, earthmoving machines, and power plants have all combined to dramatically curtail the need for oil.

Meanwhile, unexpectedly robust new reserves, especially of shale oil, in numerous regions around the world are glutting the market. It seems reasonable to say that in 2014 the increase in the global supply of petroleum and other liquid fuels was almost twice the increase in consumption.

Against this volatile background, throughout the conference there was an emphasis on sustainability in a world with a changing climate in weather and economics. The UAE is focusing on a very specific goal: generating 25% of its total power needs through clean energy by 2021.

Martin Tiffen, a senior development executive at Total, says that the short-term challenge posed by lower oil prices must be accompanied by maximizing recovery from existing fields using enhanced oil recovery (EOR) techniques and 4D seismic surveys. Initial results using EOR in Abu Dhabi show an increase in recovery from around 50% to 70%.

Neri Askand, Statoil VP for the Middle East says that technology cannot just maintain but increase production using EOR, heavy oil, tight gas and carbon capture and storage (CCS). Statoil has a goal of increasing recovery to 65% from platforms and 55% from subsea wells.

Gas too will play a key role, as Energy Minister Al Mazrouei says, “Natural gas is the cleanest form of energy and clean energy must be developed wherever possible.” Meanwhile offshore oil and gas extraction in Abu Dhabi is going to increase despite the continuing downturn in oil markets.

Engineering Construction Upswing

The engineering construction companies present at the conference reflected a cautious optimism regarding the future for service companies, especially as the sector is forecast to grow substantially over the next quarter century. Significant investment continues and many remember boom times when skilled workers were hard to find and their services went at a premium.

Remi Eriksen, CEO of DNV GL and National Drilling Company, believes this crisis should not be wasted even though the drop in drilling is particularly painful. “We won’t see things trending positively before 2017 and it may take longer. It’s a great opportunity to get inefficiencies out of the value chains to create a simpler eco-system.”

He adds that the industry will have to maintain innovation across the board including effectively attracting, developing and retaining human resources.

In the meantime a qualified and flexible workforce remains a necessity and an integral part of sector growth. Employing qualified workers is a huge burden on contractors. The problem is most acute in the procurement of skilled workers. New equipment and increased productivity may have decreased overall manpower needs but skilled workers such as welders, pipefitters and boilermakers are in demand and hard to source.

Agnes Wrodarczyk CEO of skilled-personnel supplier Central European Staffing says: “Numerous construction contracts should start soon, resulting in the usual demand for a qualified workforce. Middle East countries don’t have collective agreements regulating the level of pay in the industry (see NAECI in the UK). So the market regulates pay rates with very competitive prices and with workforce supplied from Asia. However, contractors now realize they have to consider not only the price, but the level of qualification and worker-reliability. This is great news for qualified, skilled technicians like welders and mechanical fitters. This opens doors for Central European Staffing, a company with strong a recruitment base in Eastern Europe.”

ADIPEC (The Abu Dhabi International Petroleum Exhibition and Conference) is one of the world’s biggest and most influential Oil and Gas exhibition and conferences. In 2015 (9 – 12 November) there were 95,000 attendees, 23 national pavilions, 7000 delegates and including a full complement of oil & gas companies, technology suppliers and service companies.

More about ADIPEC 2015:

Humans Still the Most Valuable Resource

More Women Needed